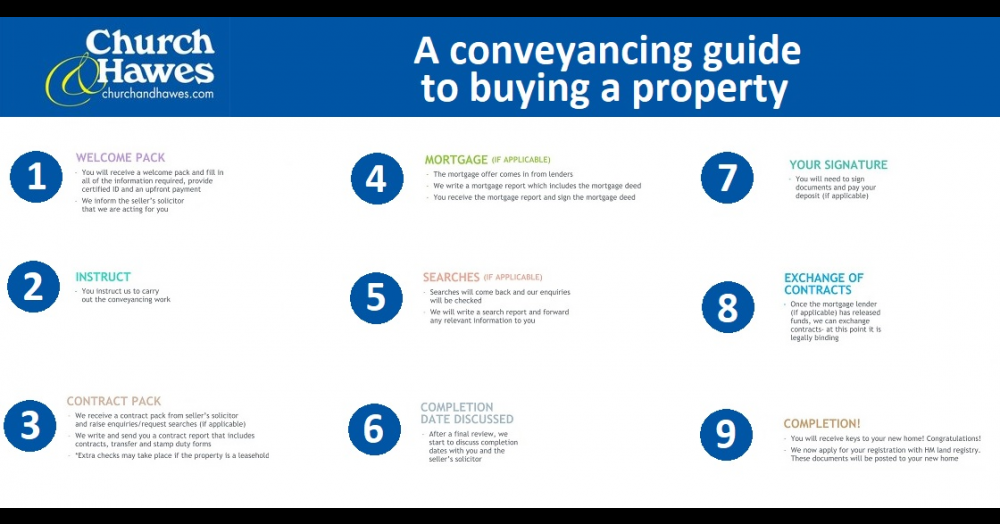

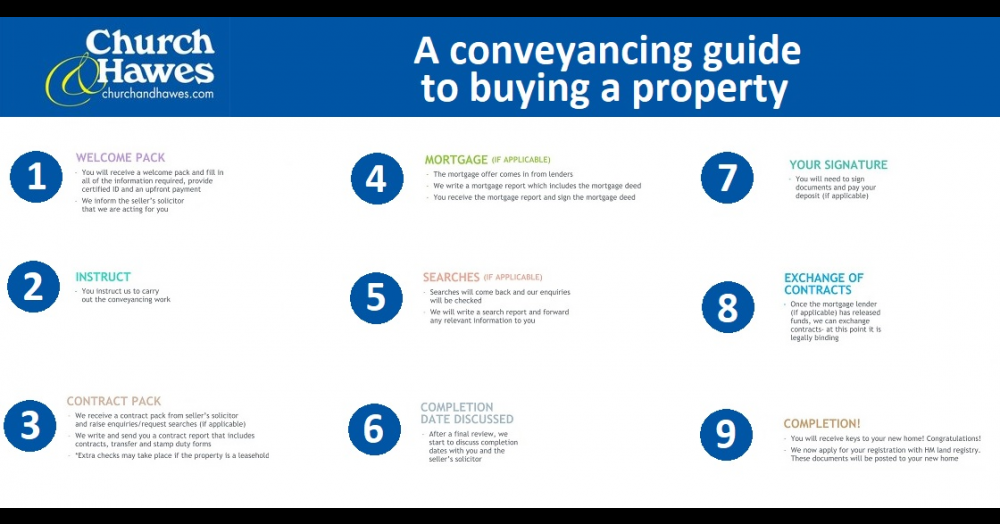

You have found your dream home, your offer has been accepted! What happens next? Here's our step by step guide to the home buying process.

Step 1: Indentify a suitable conveyancing solicitor

Once your offer has been accepted, we will request that you furnish us with details of your solicitors. They will act on your behalf for the purchase of your new home. We are able to provide you with conveyancing solicitor recommendations if you need them. Once you have appointed a solicitor they will send you their initial paperwork to complete and return along with the requested identification and payment for the searches you wish to have.

Step 2: Your solicitor will receive the draft Contract

A draft contract will be completed by the sellers solicitors. It will include; official copies (electronic deeds), property information forms and duplicates of relevant documents pertaining to the property you intend to purchase.

Step 3: Searches and investigation of Title

This step involves your conveyancer carrying out the searches that you will require for the property and review the paperwork received from your seller’s solicitors. If there is anything that needs clarification in regards to the paperwork or the property, your solicitor will get in contact with the seller’s solicitor, who they may need to contact the seller for further information.

This process can sometimes be lengthy depending on the number of queries raised.

Step 4: Receive your report

Once your solicitor has received all the replies for the queries raised and results of all the searches requested, a report is created for the property and sent to you along with your mortgage offer (if you require a mortgage otherwise you will need to supply cash funds).

You will at this point receive the financial information for the transaction, which provides you with a detailed completion statement highlighting the amounts due from you.

Step 5: Signing

Once you have confirmed you are happy with the paperwork, you need to to sign your contract and then agree a completion date with all parties involved in the transaction.

At this stage of the conveyancing process, you will transfer the deposit, usually 10% of the purchase price to your solcitor enabling them to be ready to exchange contracts (if you are buying and selling, this maybe verified as funds required from your sale).

Step 6: Exchange of Contracts

The transaction and completion date (required to be agreed before exchange) is legally binding on exchange of contracts. The deposit will be sent to the seller’s solicitor and a request for your mortgage advance will be paid from your lender (if required). Before completion, the balance of funds due from you must be with your solicitor at least one working day beforehand.

Step 7: Completion

Completion day has arrived, this is the day the full purchase price is transferred to the seller’s solicitors.

The keys are left with the Estate Agent you have purchased through and once the seller’s solicitor has confirmed they have received the funds the Estate Agent will be given the authority to realease the keys to you.

Congratulations at this stage you own your new home!